How Much Does Website Development Cost in the USA in 2026?

In the hyper-competitive digital landscape of 2026, a robust, engaging, and high-performing website isn’t just a luxury – it’s the cornerstone of your business’s success. As digital competition intensifies, so does the need for a website that not only looks good but also functions flawlessly, offers an intuitive user experience, and drives tangible business results.

But as you embark on this crucial journey, one question undoubtedly looms large:

How much does website development cost in the USA in 2026?

It’s a question with a complex answer, as website development pricing can vary as widely as the businesses that need them. From a simple online brochure to a sophisticated enterprise-level platform, the scope, features, and underlying technology significantly impact the final investment. Before diving into specific numbers, it’s vital for business owners to understand the nuances that contribute to these variations, ensuring they can budget effectively and make informed decisions that align with their strategic goals. This guide from Ndimension Labs aims to demystify website development costs in the USA for 2026, providing a comprehensive breakdown and actionable advice to help you secure a powerful digital presence.

Average Website Development Cost in the USA (2026 Updated)

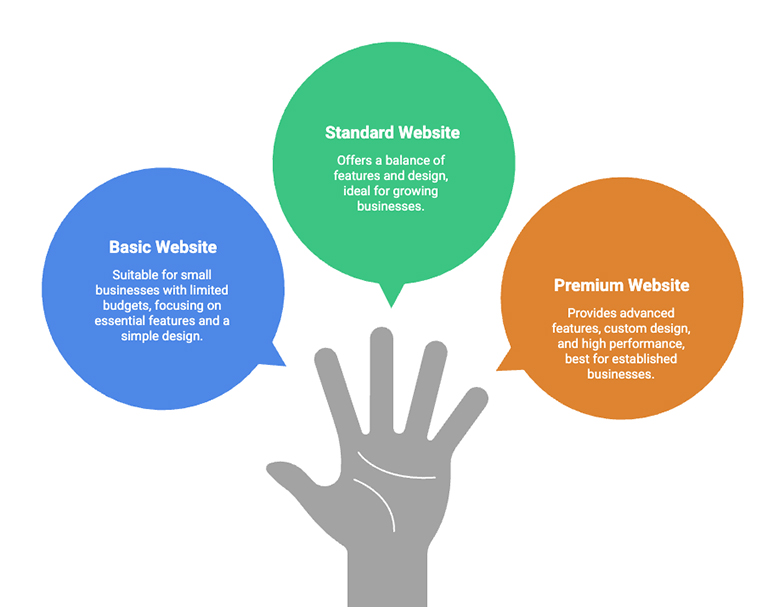

The cost of website development in the USA in 2026 is influenced by numerous factors, including the complexity of features, design sophistication, chosen technology stack, and the expertise of the development team. Here’s a realistic range of what you can expect for different types of websites:

Basic Small Business Website: $5,000 – $15,000

A basic small business website typically includes 5-10 pages, standard contact forms, mobile responsiveness, and a simple content management system (CMS) like WordPress. It’s ideal for businesses needing an online presence to showcase services, provide contact information, and establish credibility. Custom design is minimal, often relying on existing themes with branding adjustments.

Corporate Website: $15,000 – $50,000

Corporate websites are more robust, featuring a larger number of pages (15-50+), custom UI/UX design, advanced lead generation forms, CRM integration, and potentially a blog or news section. These are designed for established businesses that require a professional online representation to build brand authority, engage stakeholders, and support marketing efforts. Security and performance optimization are key considerations.

eCommerce Website: $20,000 – $100,000+

An eCommerce website involves significant complexity due to product catalogs, shopping carts, payment gateway integrations, user accounts, order management systems, and inventory management. The cost can vary dramatically based on the number of products, custom features (e.g., subscription models, personalized recommendations), and integration with existing business systems. Platforms like Shopify Plus or custom Magento solutions fall into this category.

Custom Web Application: $50,000 – $250,000+

Custom web applications are built from the ground up to solve specific business problems or provide unique services. This could include online

portals, booking systems, project management tools, or specialized SaaS platforms. The development involves extensive discovery, custom database design, complex backend logic, and often API integrations with third-party services. These projects are highly tailored and require significant development hours.

Enterprise-Level Platform: $250,000 – $1,000,000+

These are large-scale, highly complex systems designed for global businesses or organizations with extensive user bases and critical operational needs. Enterprise platforms often involve sophisticated integrations with legacy systems, advanced security protocols, high availability infrastructure, custom workflows, and ongoing feature development. Examples include custom CRM/ERP systems, large-scale B2B portals, or industry-specific software solutions.

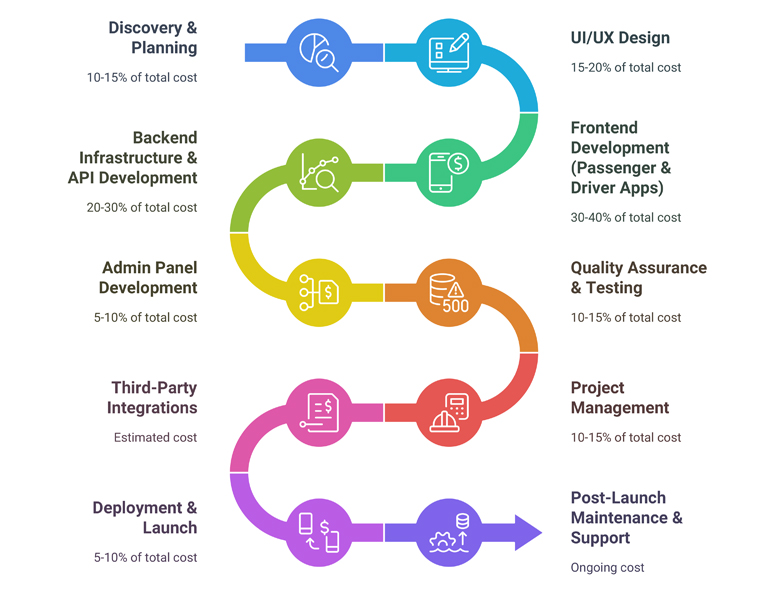

Detailed Website Development Cost Breakdown

Understanding the components that contribute to the overall cost will help you better appreciate your investment.

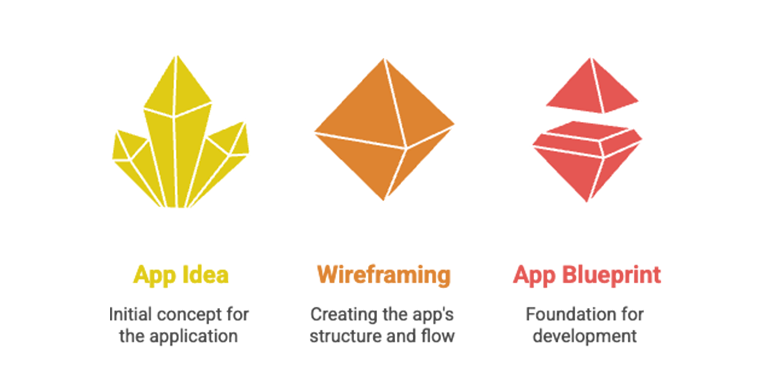

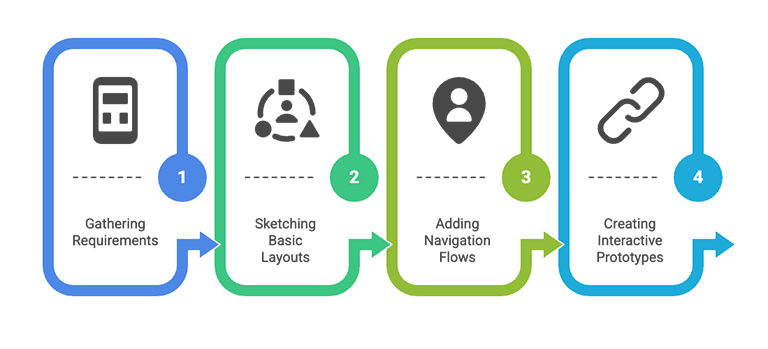

UI/UX Design ($2,000 – $40,000+)

This phase focuses on creating an intuitive, aesthetically pleasing, and user-friendly experience.

- User Interface (UI): Visual elements, branding, color schemes, typography, and interactive components.

- User Experience (UX): Wireframes, sitemaps, user flows, usability testing, and ensuring the site is easy to navigate and achieves user goals. Custom, sophisticated designs will naturally incur higher

Frontend Development ($3,000 – $60,000+)

Frontend development brings the UI/UX design to life, creating the visible parts of the website that users interact with. This involves coding with languages like HTML, CSS, JavaScript, and frameworks such as React, Angular, or Vue.js. Complexity increases with interactive elements, animations, and dynamic content.

Backend Development ($4,000 – $80,000+)

The backend is the server-side of the website, handling data storage, server logic, databases, and APIs. It’s the “engine” that powers the site’s functionality. Technologies often include Python (Django, Flask), Node.js (Express), Ruby on Rails, or PHP (Laravel, Symfony). The more complex the features (user authentication, data processing, integrations), the higher the backend development cost.

CMS Integration ($1,000 – $20,000+)

Integrating a Content Management System (CMS) allows you to easily manage website content without coding knowledge. WordPress, Drupal, and Joomla are popular choices. Custom CMS development or highly customized integrations can increase costs.

eCommerce Features ($5,000 – $50,000+)

Specific to online stores, this includes product catalog setup, shopping cart functionality, secure payment gateway integration (Stripe, PayPal), shipping calculators, inventory management, customer accounts, and order tracking.

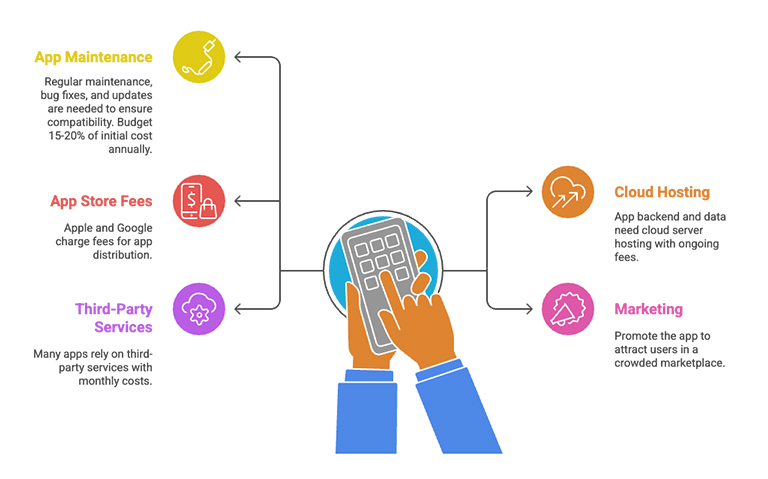

Hosting & Infrastructure ($100 – $1,000+ per month)

This covers the server space where your website resides. Costs vary based on traffic volume, storage needs, required processing power, and security features. Options range from shared hosting for small sites to dedicated servers or cloud hosting (AWS, Azure, Google Cloud) for larger, high-traffic applications.

Maintenance & Security ($500 – $5,000+ per year)

Ongoing website maintenance is crucial for optimal performance, security, and functionality. This includes software updates, backups, bug fixes, security monitoring, and content updates. Neglecting maintenance can lead to security vulnerabilities and poor user experience.

AI Integrations (Chatbots, Automation) ($3,000 – $30,000+)

Integrating Artificial Intelligence solutions like chatbots for customer support, AI-driven recommendation engines, or automation tools can

significantly enhance user experience and operational efficiency. The cost depends on the complexity and scope of the AI functionality.

Factors That Influence Website Development Cost

Several key factors will directly impact your overall investment in website development.

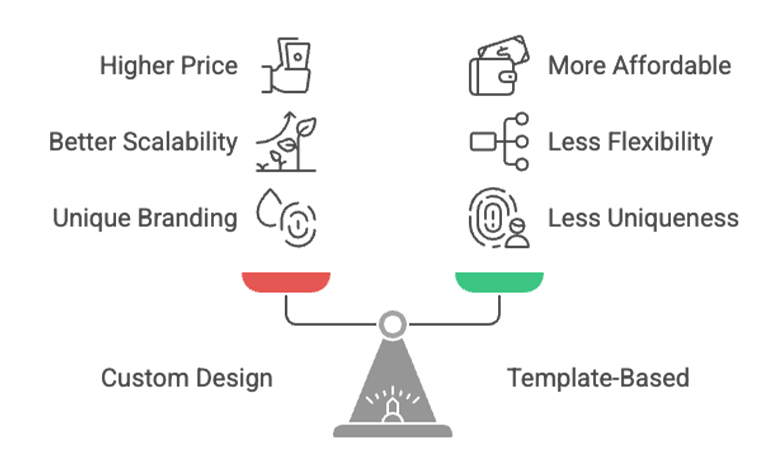

Custom vs. Template

- Custom Design: Offers unique branding, tailored functionality, and better scalability, but comes at a higher price.

- Template-Based: Utilizes pre-made themes, which are more affordable and quicker to launch, but offer less flexibility and

Choose the website development approach that fits your budget and needs

Number of Pages & Content Volume

A website with hundreds of pages and extensive content will naturally cost more to design, develop, and integrate than a 5-page brochure site.

Content creation (copywriting, photography, video) is often an additional cost.

Third-Party Integrations

Connecting your website with external tools like CRM systems (Salesforce), email marketing platforms (Mailchimp), ERPs, payment gateways, or social media APIs adds complexity and development time.

Scalability Requirements

If you anticipate significant growth in traffic or future feature additions, building a scalable architecture from the outset is essential. This upfront investment ensures your website can handle increased demands without requiring a complete rebuild later.

SEO Readiness

While ongoing SEO is a marketing effort, foundational SEO elements should be built into the website’s structure during development. This includes clean code, fast loading times, mobile-friendliness, and proper meta-tag implementation, which can add to development costs if done meticulously.

Performance Optimization

Ensuring fast loading times and smooth user interaction requires careful coding, image optimization, caching strategies, and server configuration. These optimizations are critical for user retention and search engine rankings.

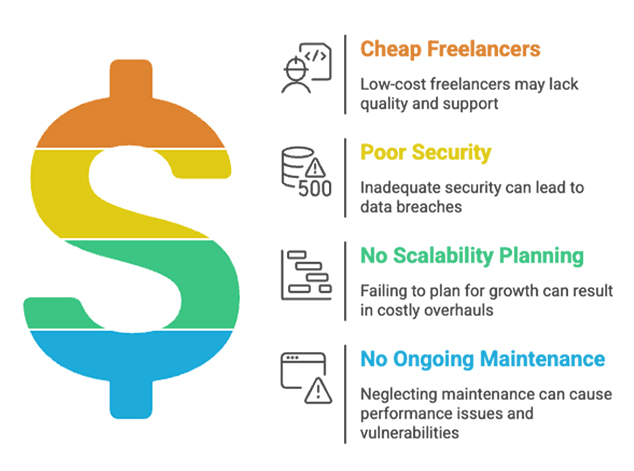

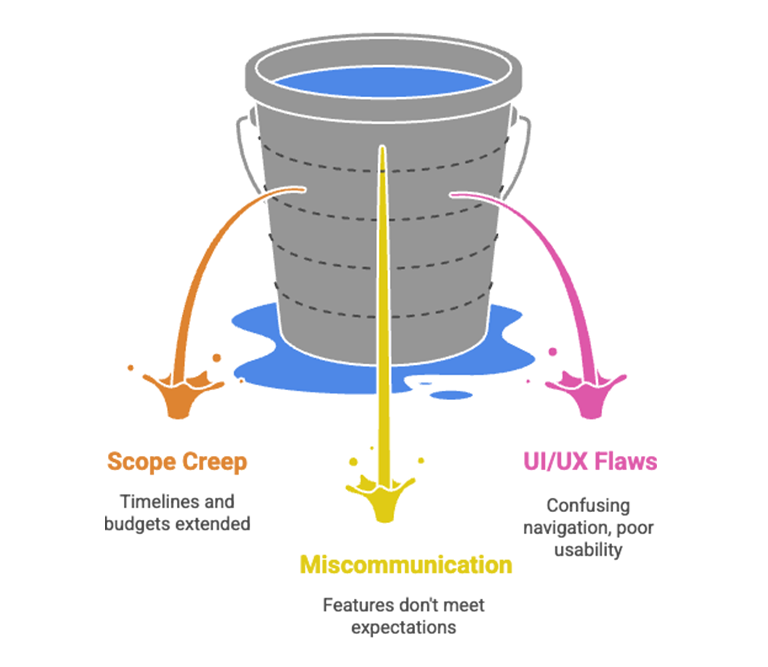

Hidden Costs Businesses Should Avoid

Being aware of potential hidden costs can save your business from unexpected expenses and project delays.

- Cheap Freelancers with No Support: While initially appealing, extremely low-cost freelancers often lack quality control, offer minimal post-launch support, and may deliver insecure or non-scalable code. The long-term cost of rectifying issues can far outweigh initial

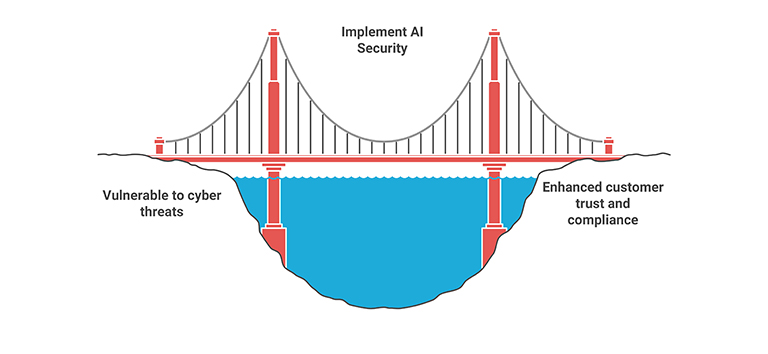

- Poor Security Implementation: Cutting corners on security can lead to data breaches, reputational damage, and costly recovery efforts. Robust security protocols are a non-negotiable investment.

- No Scalability Planning: Building a website without considering future growth can result in needing a complete overhaul as your business expands, wasting initial investment.

- No Ongoing Maintenance: Neglecting regular updates, backups, and security checks leaves your website vulnerable to attacks and performance degradation, leading to more expensive fixes down the

Hidden Cost to Avoid

Cost Comparison Table: Website Development in the USA (2026)

| Website Type | Estimated Cost Range (USD) | Key Features |

| Basic Small Business Website | $5,000 – $15,000 | 5-10 pages, contact form, responsive design, basic CMS |

| Corporate Website | $15,000 – $50,000 | 15-50+ pages, custom UI/UX, CRM integration, blog, enhanced security |

| eCommerce Website | $20,000 – $100,000+ | Product catalog, shopping cart, payment gateway, inventory, user accounts |

| Custom Web Application | $50,000 – $250,000+ | Tailored functionality, complex logic, database design, API integrations |

| Enterprise-Level Platform | $250,000 – $1,000,000+ | Large scale, high traffic, extensive integrations, advanced security & features |

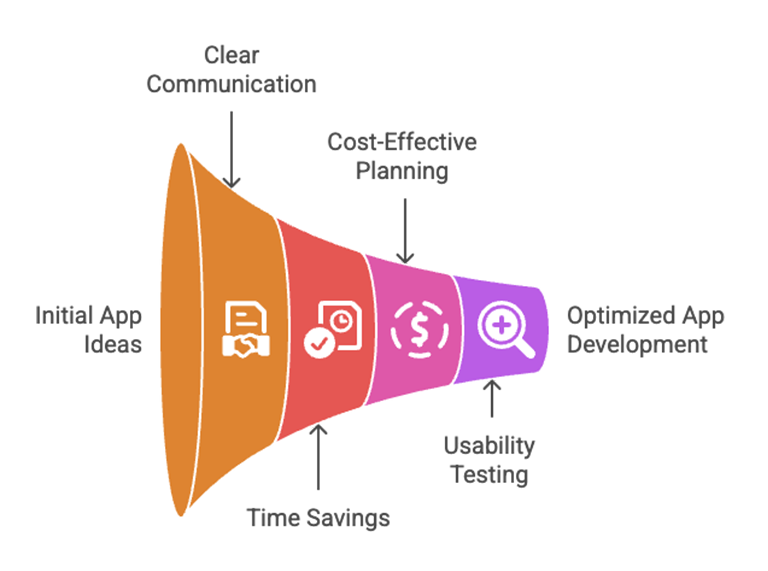

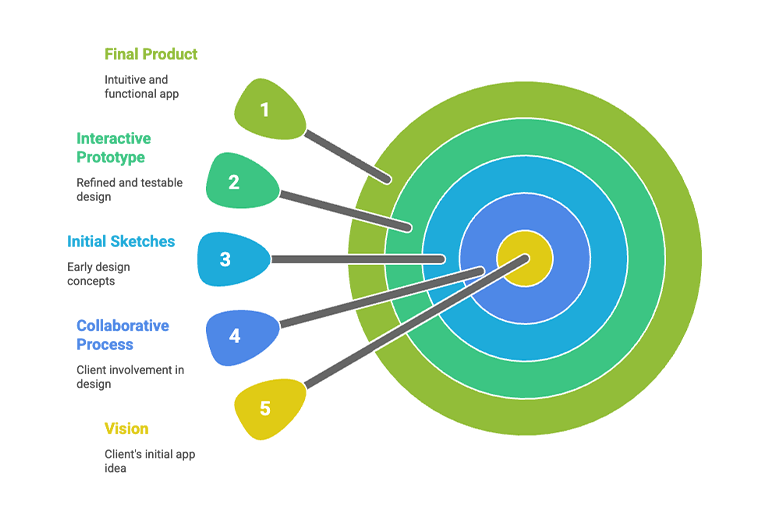

How to Budget Smartly for Website Development in 2026

Budgeting for your website development requires a strategic approach, especially for startups and growing businesses.

- Define Your Goals Clearly: What do you want your website to achieve? (e.g., lead generation, online sales, information hub, internal tool). Clear goals will help define the necessary features.

- Prioritize Features: Distinguish between “must-have” and “nice-to-have” features. Launch with core functionality and plan for future enhancements in phases.

- Research and Get Multiple Quotes: Obtain detailed proposals from several reputable web development companies. Compare not just price, but also their portfolio, approach, and client testimonials.

- Allocate for Post-Launch Costs: Remember hosting, domain registration, SSL certificates, ongoing maintenance, security updates, and digital marketing (SEO, PPC). These are crucial for long-term

- Consider a Phased Approach: For larger projects, break down development into manageable phases. This allows you to launch a minimum viable product (MVP) sooner, gather feedback, and iterate while managing cash flow.

- Focus on Value, Not Just Price: The cheapest option isn’t always the best. A slightly higher upfront investment in a quality, scalable website will save you significant money and headaches in the long

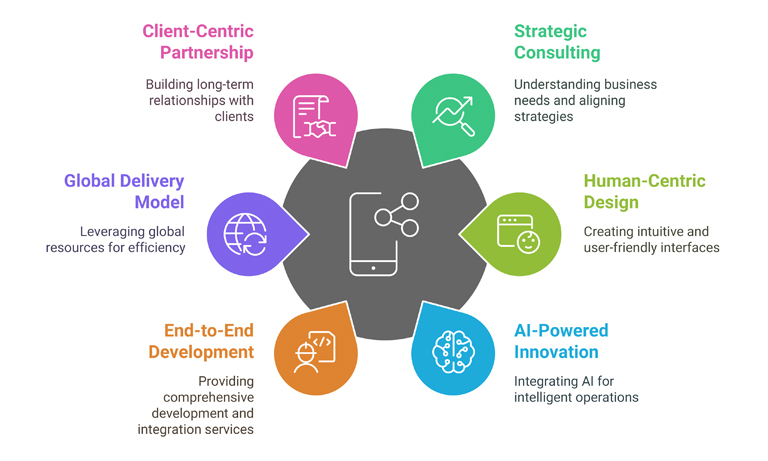

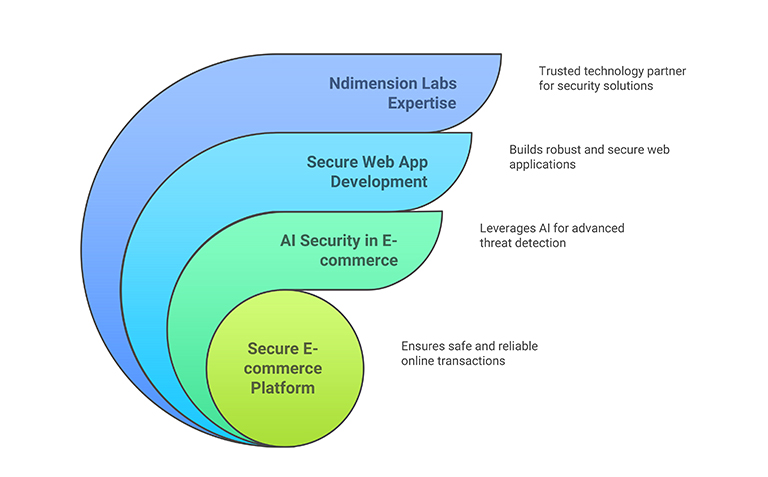

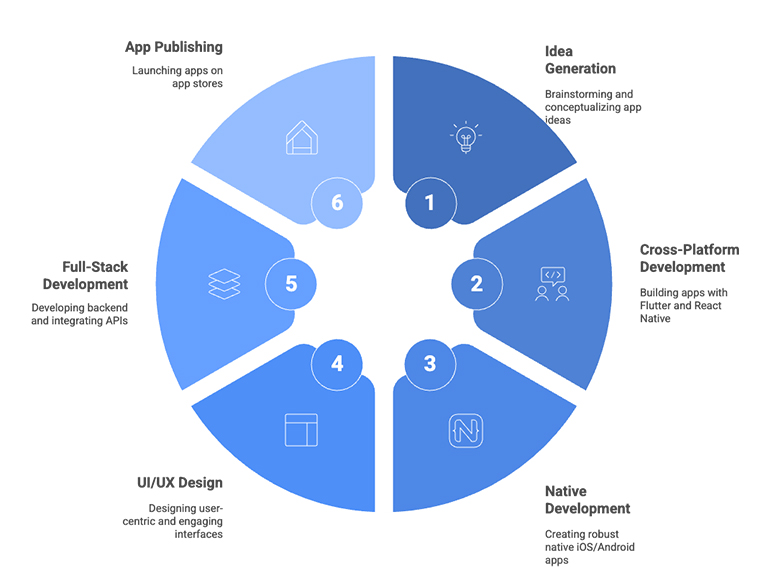

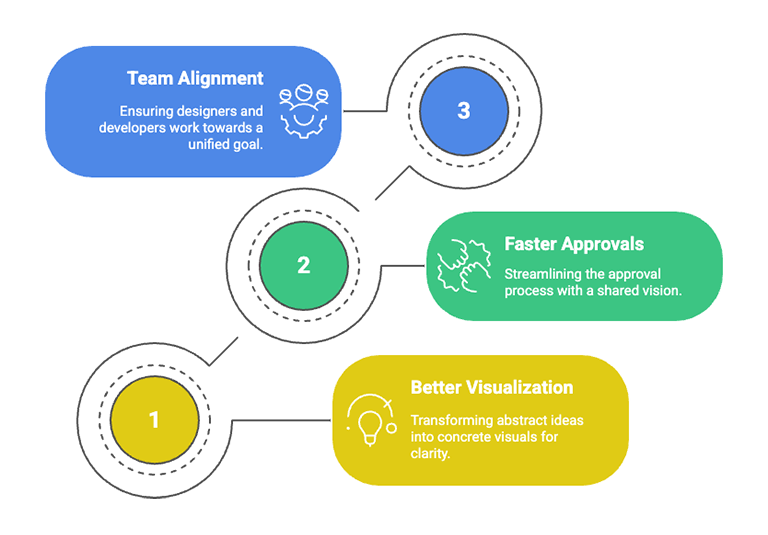

Why Choose a Professional Development Partner Like Ndimension Labs

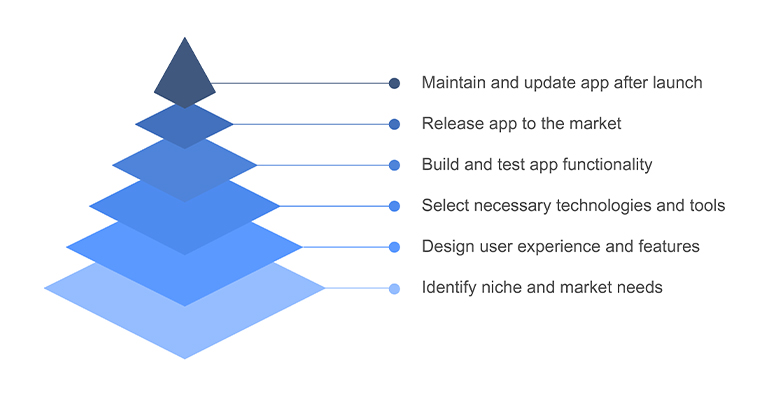

Navigating the complexities of website development in 2026 requires more than just coding; it demands strategic insight, technical excellence, and a partner you can trust. Ndimension Labs is a technology-driven web development company with a proven track record of delivering custom solutions that empower businesses in the USA.

We understand that your website is a critical asset. Our team specializes in creating scalable, secure, and performance-optimized websites that are not only aesthetically pleasing but also engineered for business growth. From initial consultation to post-launch support, we follow a structured delivery process, ensuring transparency, communication, and exceptional results.

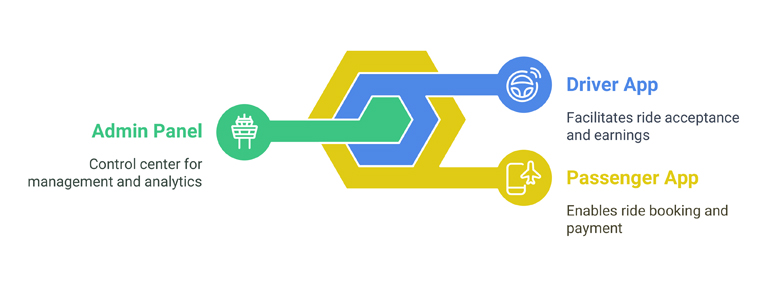

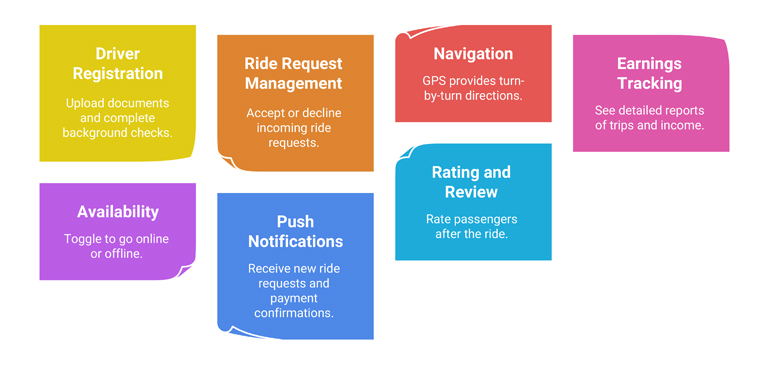

Whether you need a sophisticated eCommerce platform, a custom web application, or an enterprise-level solution, Ndimension Labs brings the expertise in website development, mobile app development, custom software, and cutting-edge AI solutions to bring your vision to life.

The Power of Ndimension Lab’s Integrated Web Development Expertise

We don’t just build websites; we build digital foundations designed for your future success.

Frequently Asked Questions (FAQ) About Website Development Cost

Q1: Why do website development costs vary so much?

A1: Costs vary due to factors like complexity of features, custom design vs. templates, number of pages, type of CMS, integrations with third-party systems, and the experience level of the development team. A simple brochure site will be far less expensive than a complex eCommerce platform or custom web application.

Q2: Is it cheaper to use a website builder (like Wix or Squarespace) than hiring a developer?

A2: For very basic websites with limited functionality, website builders can be cheaper and quicker to set up. However, they often come with limitations in customization, scalability, and unique features. For businesses requiring custom design, complex integrations, or robust functionality, hiring a professional web development company provides a more tailored, scalable, and powerful solution.

Q3: How long does it take to develop a website?

A3: The timeline varies significantly with complexity. A basic small business website might take 4-8 weeks. A corporate website or a medium-sized eCommerce site could take 3-6 months. Custom web applications or enterprise-level platforms can take 6 months to over a year, depending on the scope.

Q4: What ongoing costs should I expect after my website is launched?

A4: Beyond the initial development, expect ongoing costs for domain registration (annual), hosting (monthly/annually), SSL certificates (annual), website maintenance and security updates (monthly/annually), and potential content updates or digital marketing efforts (SEO, PPC).

Q5: Can AI integrations significantly increase website development costs?

A5: Yes, integrating advanced AI features like custom chatbots, sophisticated recommendation engines, or complex automation can increase costs. However, the investment often pays off through enhanced user experience, operational efficiency, and deeper customer engagement. Basic AI integrations like simple chatbots may have a more moderate impact on cost.

Ready to Elevate Your Digital Presence?

Understanding the website development cost in USA for 2026 is the first step toward a successful digital transformation. At Ndimension Labs, we believe in transparent pricing and delivering exceptional value. We are

committed to building high-performing, secure, and future-proof websites that drive real results for businesses across the USA.

Don’t let the complexity of budgeting hold you back. Request a free consultation with our experts today to discuss your project requirements. Let us provide you with a detailed, custom quote tailored to your specific needs and help you build a powerful online platform that sets you apart in the competitive digital landscape of 2026.

Contact Ndimension Labs now for your personalized web development estimate!

Ndimension Labs doesn’t just build software; they engineer digital ecosystems that enhance operational efficiency, foster innovation, and lay the groundwork for sustainable scaling.

Ndimension Labs doesn’t just build software; they engineer digital ecosystems that enhance operational efficiency, foster innovation, and lay the groundwork for sustainable scaling.