How Much Does Website Development Cost in the USA in 2026?

How Much Does Website Development Cost in the USA in 2026? In the hyper-competitive digital landscape of 2026, a robust,…

Imagine you’re a freelance graphic designer in Mumbai, and you’ve just completed a project for a client in New York. The work is done, but the payment process is where the real headache begins. You’re bracing for a frustrating few days of high currency conversion fees, confusing international wire transfer forms, and waiting for the money to finally hit your bank account.

The same scenario plays out for small business owners exporting goods, digital creators selling services to a global audience, and even families sending money home. The dream of a seamless, affordable, and instant global payment system has always been just that—a dream.

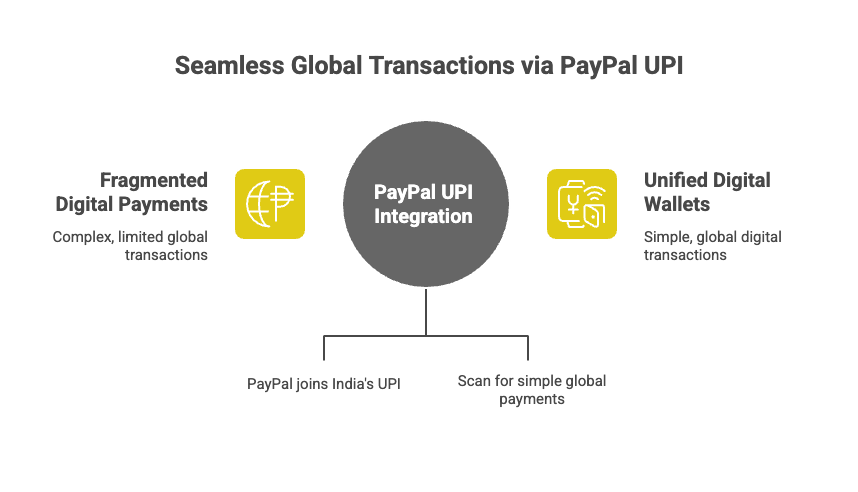

But what if that dream is about to become a reality? A major shift is underway in the world of digital payments, and it’s led by an unlikely but powerful partnership: the global fintech giant PayPal joining hands with India’s revolutionary Unified Payments Interface (UPI). This PayPal UPI integration is not just another headline; it’s a monumental step that could redefine the future of digital wallets, making global transactions as simple as scanning a QR code.

In this comprehensive guide, we’ll dive deep into this landmark collaboration, exploring what it means for consumers, businesses, and the broader global cashless economy. We’ll cover the technology behind it, its significant benefits, and the exciting fintech trends 2025 that this move is setting in motion.

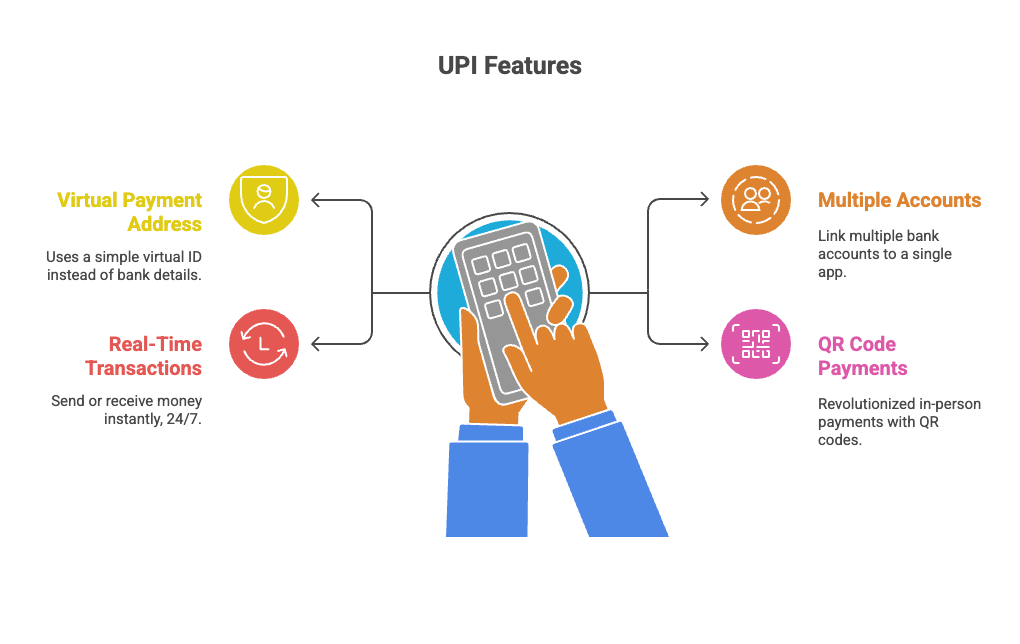

Before we get to the partnership, let’s understand the backbone of this revolution: UPI. Developed by the National Payments Corporation of India (NPCI) and launched in 2016, the Unified Payments Interface (UPI) is a real-time payment system that enables instant,

peer-to-peer, and peer-to-merchant transactions. Here’s how it works:

The numbers speak for themselves. According to recent data from the Press Information Bureau (PIB), UPI now processes over 18 billion transactions every month, making it the world’s leading real-time payment system.

This remarkable success, fueled by high smartphone penetration and government support, has proven the effectiveness and scalability of UPI’s model. It now accounts for over 85% of India’s digital retail payments and a significant chunk of global real-time payments.

For years, PayPal has been a dominant force in cross-border payments, connecting a user base that is projected to reach nearly 250 million by the end of 2025. However, traditional international payments often come with friction, including high fees and slower processing times.

PayPal’s new platform, “PayPal World,” is designed to solve this very problem. This is where the PayPal UPI integration comes in. By partnering with NPCI International Payments Limited (NIPL), PayPal is essentially creating a bridge between its massive global network and India’s highly efficient UPI system. This move is part of a broader strategy to connect the world’s

largest payment systems and digital wallets, with initial partners including China’s Tenpay Global and Latin America’s Mercado Pago.

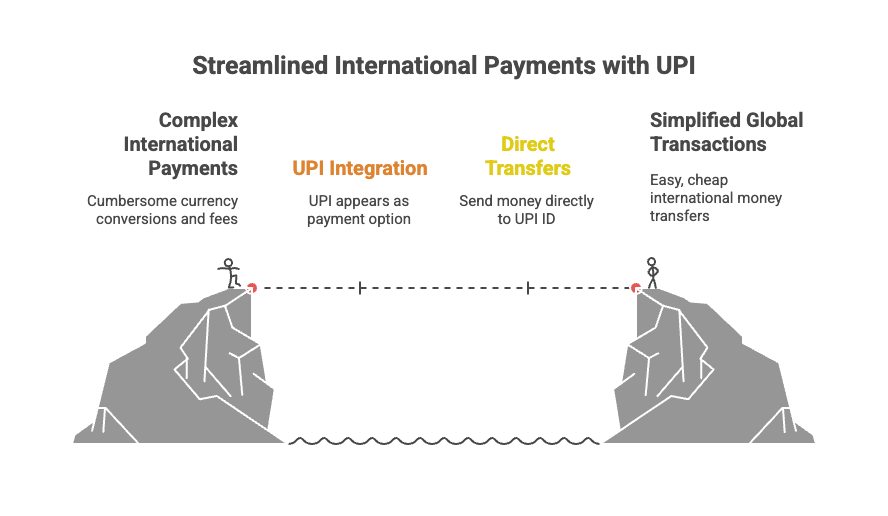

What does this mean in a practical sense?

This partnership is a powerful validation of India’s digital finance innovation and its potential to set a global standard for cross-border UPI transactions.

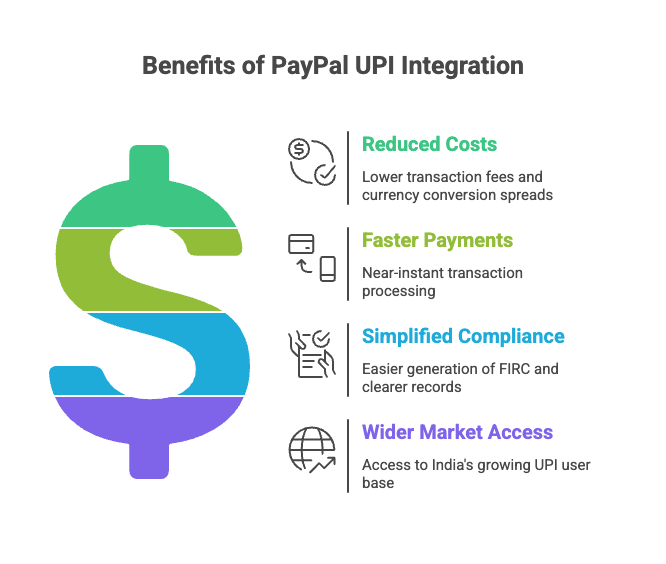

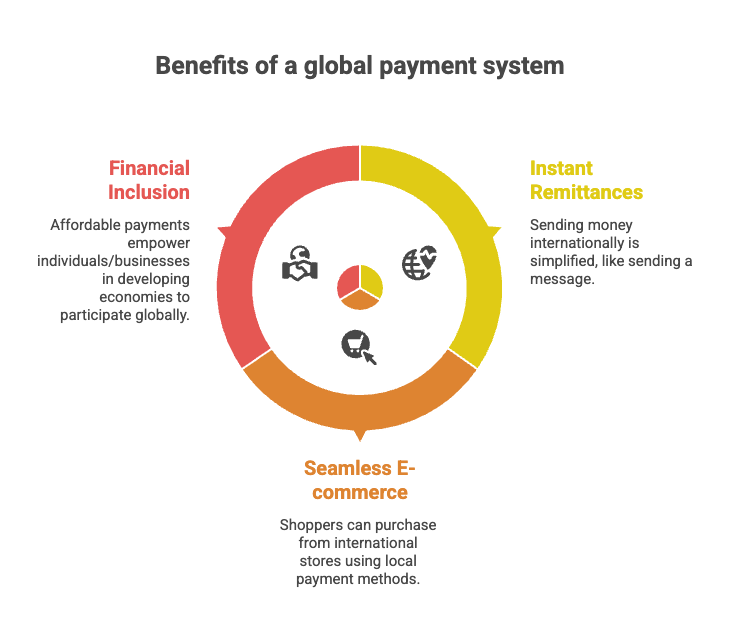

For the millions of freelancers, small businesses, and startups, this PayPal UPI integration is nothing short of a revolution. The traditional methods of receiving international payments have been notoriously difficult and expensive.

Let’s look at the key benefits for these groups:

PayPal CEO Alex Chriss has emphasized the company’s commitment to solving the “incredibly complex” challenge of moving money across borders. He believes that this platform will make it simple for nearly two billion consumers and businesses.

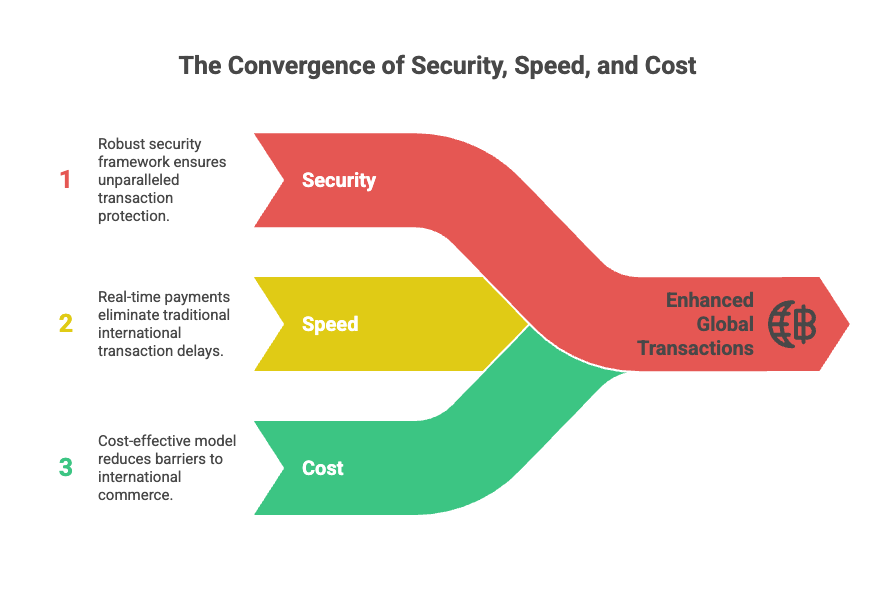

The core strengths of this partnership lie in the combined benefits of both platforms.

This synergy highlights a major fintech trend: a move away from “walled gardens” and towards a globally interoperable payment ecosystem.

This partnership is a bellwether for the future of fintech. Industry experts view this as a landmark moment that validates India’s position as a global leader in digital finance innovation. This

move is a testament to the fact that homegrown payment systems can scale to a global level and compete with legacy financial infrastructures.

The long-term impact of this is profound. As more countries and payment systems join the network, we can expect to see a truly interconnected global financial landscape. This could pave the way for:

This is a clear signal that cashless economy is no longer a localized concept; it is a global reality being built one partnership at a time.

The partnership between PayPal and UPI is more than just a business deal; it is a powerful symbol of a new era in global finance. It represents the triumph of a user-friendly, efficient, and innovative system from India on the world stage. For anyone who has ever been frustrated by high forex fees, payment delays, or the complexity of international transactions, this integration offers a beacon of hope. It promises a future where money flows across borders as effortlessly as information, making the world a more financially connected and inclusive place. This is a game-changing moment, and it’s a clear sign that the future of digital wallets is faster, cheaper, and more interconnected than ever before.

Yes. With the launch of PayPal World, Indian users will be able to make payments to international merchants using their existing UPI-linked bank accounts. The option to pay with UPI will appear at checkout on websites that use PayPal.

While the exact fee structure for cross-border UPI transactions is still being detailed, the partnership’s core goal is to reduce the costs associated with traditional international payments. While there may be a nominal fee for currency conversion, the overall cost is expected to be significantly lower than legacy wire transfer systems.

Cross-border UPI transactions will leverage the robust security features of both UPI and PayPal. UPI uses a two-factor authentication process (UPI PIN) and end-to-end encryption. PayPal adds its own advanced fraud detection and buyer/seller protection mechanisms, creating a highly secure environment for international payments.

PayPal has indicated that the “PayPal World” platform and its initial partnerships, including the UPI integration, are expected to roll out in phases. While a full global rollout may take some time, initial functionalities are set to go live in the latter part of 2025.

How Much Does Website Development Cost in the USA in 2026? In the hyper-competitive digital landscape of 2026, a robust,…

As a technology consultant, one of the most frequent questions I get from business owners and startup founders isn't "What's…

I remember standing by the window of our Kolkata office on a rainy Tuesday in early January 2025. The city…